Target Corporation (NYSE: TGT) is navigating a challenging retail landscape ahead of next week’s earnings, as sales and margins face pressure from economic uncertainty and restrained consumer demand. With a significant portion of its assortment in discretionary categories, the retailer’s turnaround strategy remains centered on enhancing customer value through improved shopping experience and targeted promotional activity.

Estimates

Target’s third-quarter 2025 earnings report is scheduled for release on Wednesday, November 19, at 6:30 am ET. Estimates point to a modest Q3 performance, after delivering mixed results in the first half of the year. Analysts predict a 1% year-over-year decline in sales to $25.38 billion for the October quarter. The consensus earnings forecast is $1.73 per share, vs. $1.85 per share last year.

Over the past several weeks, Target’s stock has been trading below its 12-month average price of $108.55. The value has declined by nearly one-third since the beginning of the year, underperforming the broader market. The company has a good track record of raising quarterly dividends, and currently presents a yield of 5.1% which is well above the S&P 500 average.

Financials

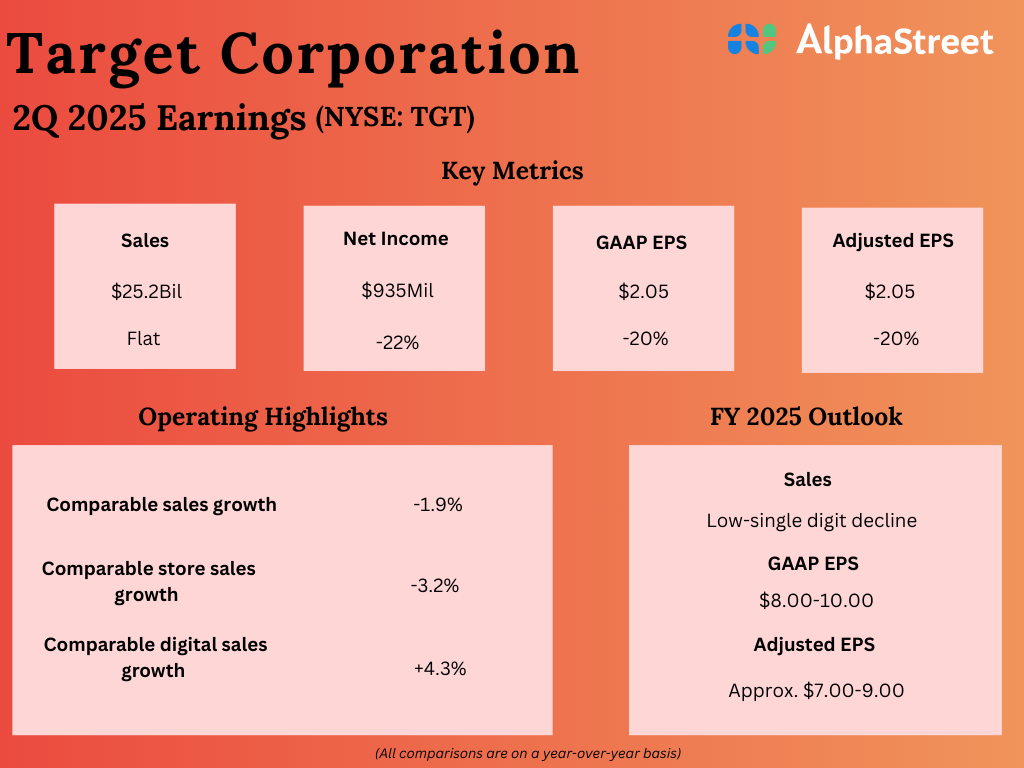

In the second quarter of fiscal 2025, Target’s comparable sales declined about 2% from the prior-year period. At $25.2 billion, Q2 net sales were broadly unchanged year-over-year, but came in above Wall Street’s expectations. Adjusted earnings dropped 20.2% annually to $2.05 per share during the three months. The bottom-line beat estimates, after missing in the trailing two quarters. On a reported basis, net profit was $935 million, down 21.5% compared to last year.

From Target’s Q2 2025 Earnings Call:

“We already benefit from strong partnerships with vendors, including Starbucks, Apple, CBS, Disney, EssilorLuxottica, and Champion. We see an opportunity to lean further into those relationships while being open to new ones down the road. Another example is our recent decision to invest in the more than 100 retail partners on our ship to marketplace by eliminating markups on same-day deliveries from their stores. Target’s desirability as a partner is a unique attribute of our brand and the way we go to market, and we’ll be looking for more opportunities to leverage that strength in the years ahead.”

Cautious Targets

Taking a cue from the unimpressive Q2 outcome, the Target leadership issued cautious guidance for FY25 – it targets a low-single-digit decline in 2025 sales. Full-year adjusted earnings per share are expected to be in the $7.00-9.00 range, and unadjusted income in the range of $8.00 per share to 10.00 per share.

Target is headed for a leadership change in early February when COO Michael Fiddelke is expected to succeed Brian Cornell as chief executive officer. As part of its efforts to streamline operations and achieve cost-efficiency, the company recently announced a major layoff that affects around 1,800 employees.

Shares of Target experienced weakness during Tuesday’s session, extending the recent downturn. They have declined about 6% in the past six months.